By Brian McKay

Sketching a foolproof financial plan is one of the most important exercises that you should engage in as soon as you start earning. An appropriate plan will help you to save a lot more in the long run in comparison to what you have envisioned. You don’t want to let your hard earned money go to waste!

Add to Flipboard Magazine.

Take the initiative; sketch up a plan, by way of which you will be able to channelize your earnings in an efficient way that will be beneficial for you as well as your family. You need not act like a miser but all you need to do is act smartly which in turn will secure yours as well as your whole family’s future.

An insight

The first thing that you need to do in order to understand the importance of financial planning is engage yourself in an innovative exercise. It is a simple exercise whereby you need to multiply your annual income with the number of years that you intend to work. You will be awestruck at figure. Moreover, this figure does not take into consideration all the increments, salary hike and promotions that are going to come in your career path. So the figure is going to far more than that.

Now, consider the fact that how much research and planning you need indulge in before investing on a computer or any kind of gadgets or for selecting your house or for any other heavy expense. Then isn’t it rationale for you to invest some quality time for planning your whole life’s earning as well? This will help you secure your future in a systematic way.

Sorting out problems

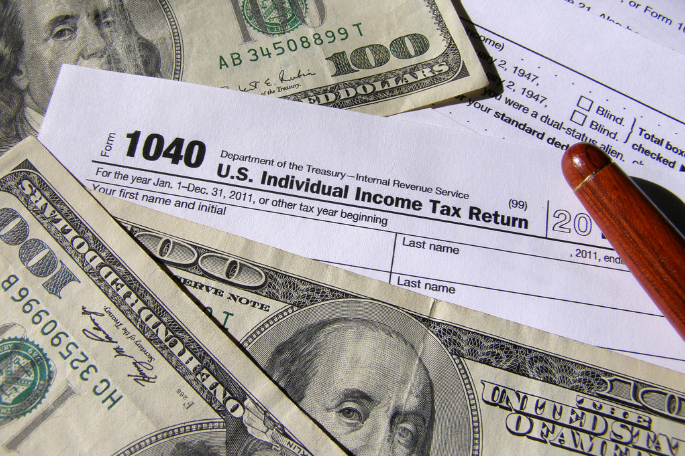

The main reason that so many people have income problems is because they’re dealing with massive drains on their finances. Bad spending habits can be a problem here, and we’ll look into that in a second. But much of the time the problem isn’t with conscious spending habits as it is with the long-standing problems of bills and debts.

So how do we mitigate our debts to ensure that we can maximize our income and channel more of our money towards more useful avenues? First of all, killing your debts is essential. Those who have earning enough to make hefty repayments every month should do so, instead of using that money on more frivolous purchases. If you’re in need of more specialized assistance, then you should research your options carefully to ensure you choose the right plan to help your debt. Don’t be tempted to put off dealing with debt indefinitely; many people do this as a means to maximize their income, but it will only make matters worse in the long run.

Check your spending habits

A concrete financial plan will also help to keep a check on the spending habits. Prepare a monthly budget whereby you can allocate the funds that you require to spend every month and also save a stipulated amount. In this way you will be able to control your expenditure much more efficiently. It can help prevent you indulging in impulsive shopping and save a lot in the long run.

Perhaps one of the best ways of doing this is to ensure that you’re really keeping detailed track of all your spending. Keep an Excel spreadsheet that tracks your spending – or a Google Sheet document if you don’t have Excel – and look into mobile apps that can help you keep track of these things on the go.

Execute the plan

One important fact that all planners need to remember is that the plans you are making need to be executed properly as well or else the plan will be of no use! Make a strict note of all the plans you are making as well as your expenses. In this way you would get a clear understanding of all your spending and it will help you to learn from your mistakes as well.

Things have gotten a lot better in the past couple of years, but the global economic scenario is still a little volatile; therefore we need to prepare ourselves for combating any kind of adversities that may arise in the future course of time. If you start preparing yourself from the initial stage by checking your spending habits, even in the face of an extremely worse situation you would not be affected adversely. The better you execute the plan, the better a financial place you’ll be in – which can be very useful if you need a loan in the future. Take the initiative to help yourself as well as your family by curbing your extravagant spending habits!

Recent Comments