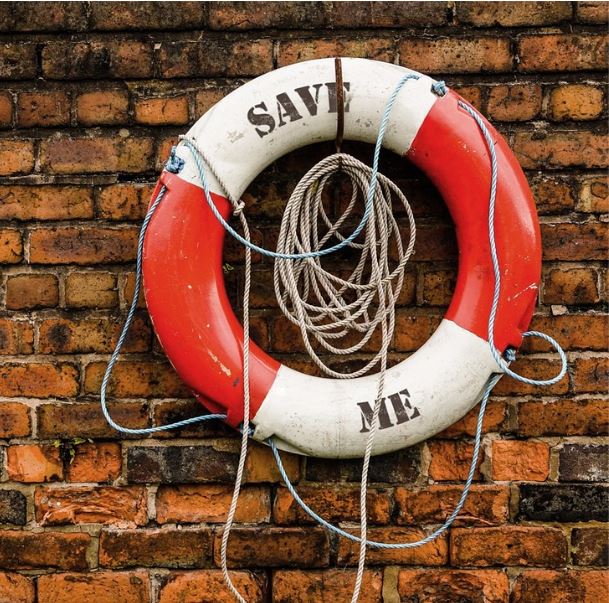

Did you know that the average American owes more than $34,000? In some age groups, this figure rises to up to $134,000. If you’re in debt, you’re certainly not alone, but the statistics may not offer a great deal of comfort. Money worries are an incredibly common source of stress and anxiety, but there are practical solutions out there. Here are some debt survival strategies to help you stay afloat when the tide turns.

Image credit https://pixabay.com/en/life-saving-swimming-tube-save-me-737370/

Face up to reality

Many of us are guilty of ignoring statements, failing to check our balances and scanning or swiping a card without giving it a second thought. It’s very easy to lose track of spending and to chuck letters that come through the mail on a pile of unopened papers. It’s much more difficult to front up to the problem and face up to reality. Sadly, at some point, you’ll have to do this, and the sooner you take that first step, the better. It’s hugely beneficial to understand exactly what is going on with regards to your financial situation. Check all your statements, look at your accounts, and work out who you owe and how much debt you’re in.

Ask for help

If you were feeling ill, you probably wouldn’t hesitate to see a doctor. If you’ve got financial issues, there are experts out there that can help you. It may be embarrassing or nerve-wracking to sit down with a financial adviser, but remember that professionals see people like you day in, day out, and they are there to offer advice and guidance, rather than judgment. It’s highly likely that you will feel much better after talking about your situation and figuring out a strategy that will help you get back on the right track. It’s common to feel alone when you’re in debt, but there are always people there. You can see an independent adviser, contact a legal firm that offers cheap bankruptcy help or get in touch with charities that offer face to face or telephone consultations. Speaking to an expert can help to clarify your situation, and provide you with useful information about how you can move forward. Many people assume that there’s no way out when they can’t answer their phone, and they dread every knock at the door, but that simply isn’t the case.

Change your spending habits

Most of us get into debt because we spend more than we earn. In an age when a large proportion of people have access to credit cards, it’s easy to get used to living beyond your means. The Census Bureau estimates that more than 183 million Americans have a credit card. If you’re prone to overspending, there are some steps you can take to try and close the gap between your income and your outgoings. Start by budgeting. Work out exactly how much you can afford to spend per week or month, and stick to this figure. The next step is to take control. If you can’t resist the temptation to spend money, consider giving your cards to your partner or a relative and think about going to counseling. You could also explore options such as putting a cap on your daily spend on a debit card and reducing your credit card limit.

If you’re in debt, you may feel like there’s no way out, but hang on in there. Help is available, and there are strategies you can employ to keep your head above water.

Recent Comments